True Price of a New Car Unveiling the Hidden Costs

Manufacturer’s Suggested Retail Price (MSRP) vs. True Price

True price of new car – The Manufacturer’s Suggested Retail Price (MSRP) is often the first number potential car buyers see, but it rarely reflects the actual price paid. Understanding the difference between MSRP and the true price is crucial for making an informed purchase decision. This involves considering various factors that influence the final negotiated price.

Factors Influencing Final Negotiated Price

Several factors contribute to the discrepancy between MSRP and the final sale price. These include market demand for the specific model, the dealer’s inventory levels, prevailing interest rates, the buyer’s negotiating skills, and available incentives or rebates offered by the manufacturer.

MSRP, Invoice Price, and Final Sale Price Comparison

| Model | MSRP | Invoice Price | Final Sale Price |

|---|---|---|---|

| Toyota Camry | $26,000 | $24,000 | $25,000 |

| Honda Civic | $23,000 | $21,000 | $22,000 |

| Ford Escape | $28,000 | $25,500 | $27,000 |

Impact of Dealerships and Negotiation

Source: wtsp.com

Dealerships play a pivotal role in setting the final price. Their profit margins are influenced by the difference between the invoice price they pay and the price they sell the vehicle for. Understanding this dynamic is key to effective negotiation.

Strategies for Negotiating a Lower Price

Consumers can leverage several strategies to negotiate a lower price. Thorough research on comparable models and prices, demonstrating a willingness to walk away, and highlighting competing offers can significantly impact the final price. Knowing the invoice price is also a powerful tool.

Dealership Negotiation Tactics

Dealerships often employ various tactics during negotiations, including highlighting add-ons, focusing on monthly payments rather than the total price, and using high-pressure sales techniques. Being aware of these tactics helps consumers remain focused on their goals.

Step-by-Step Guide for Effective Car Price Negotiation

- Research and determine a target price.

- Know the invoice price of the vehicle.

- Visit multiple dealerships and obtain multiple quotes.

- Negotiate the price before discussing financing.

- Be prepared to walk away if the deal isn’t favorable.

- Review all documents carefully before signing.

Financing and Interest Rates: True Price Of New Car

Financing options significantly impact the overall cost of a new car. The interest rate, loan term, and down payment all influence the total amount paid over the life of the loan.

Impact of Loan Terms and Interest Rates, True price of new car

- Longer loan terms result in lower monthly payments but higher total interest paid.

- Lower interest rates reduce the total cost of the loan.

- A larger down payment reduces the loan amount and interest paid.

Factors Influencing Interest Rates

- Credit score

- Loan term

- Type of vehicle

- Prevailing market interest rates

Total Cost of a Car Loan Under Different Scenarios

- Scenario 1: $25,000 loan, 60 months, 5% interest: Total cost approximately $28,100

- Scenario 2: $25,000 loan, 72 months, 5% interest: Total cost approximately $29,600

- Scenario 3: $25,000 loan, 60 months, 7% interest: Total cost approximately $29,600

Additional Costs Beyond the Sticker Price

Numerous costs beyond the sticker price contribute to the true cost of a new car. These often overlooked expenses can significantly increase the total price.

Breakdown of Additional Costs

A visual representation would show a pie chart. A large segment would represent the vehicle’s purchase price. Smaller segments would represent sales tax (typically 6-10% depending on location), government fees (registration, title fees, etc., varying by state and municipality), dealer fees (document fees, preparation fees, etc.), and potentially extended warranties or add-on packages.

Depreciation and Resale Value

Car depreciation is a significant factor impacting the true cost of ownership. Understanding depreciation rates and factors influencing resale value helps make informed decisions.

Depreciation Rates and Resale Value

Source: amazonaws.com

Depreciation rates vary considerably depending on the make, model, and features of the vehicle. Luxury cars and sports cars tend to depreciate more quickly than reliable, fuel-efficient models. Proper maintenance and low mileage can positively influence resale value.

Hypothetical Scenario: Total Cost of Ownership Over Five Years

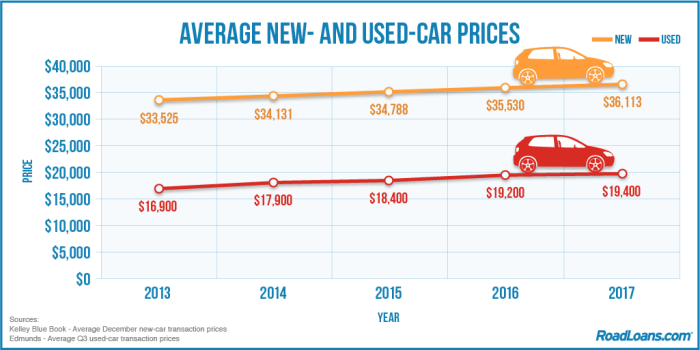

Source: roadloans.com

Let’s assume a car purchased for $25,000 depreciates at an average annual rate of 15%. After five years, its value might be approximately $11,000. This depreciation, combined with other costs like insurance, maintenance, and fuel, illustrates the total cost of ownership exceeding the initial purchase price substantially.

Hidden Fees and Add-ons

Dealerships may try to inflate the final price with various hidden fees or add-ons. Being aware of these and knowing how to negotiate them is crucial.

Common Hidden Fees and Mitigation Strategies

| Hidden Fee | Typical Cost | Mitigation Strategy |

|---|---|---|

| Dealer Prep Fee | $500-$1000 | Negotiate or shop around for lower fees. |

| Extended Warranty | Varies | Carefully evaluate the need and compare prices. |

| Paint Protection | $500-$1000 | Assess the need and consider alternatives. |

| Fabric Protection | $200-$500 | Consider alternatives like DIY protection. |

Top FAQs

What is the difference between MSRP and invoice price?

MSRP is the manufacturer’s suggested retail price, while the invoice price is what the dealer pays the manufacturer for the vehicle. The invoice price is typically lower than the MSRP, providing a starting point for negotiations.

How can I avoid hidden fees?

Carefully review all documents before signing. Ask specific questions about any fees you don’t understand. Negotiate the price upfront, including all fees, to avoid surprises.

Determining the true price of a new car involves more than just the sticker price; factors like taxes, fees, and optional extras significantly inflate the final cost. For instance, understanding the true cost might involve researching specific models, such as checking the scorpio car new model price and comparing it to similar vehicles. Ultimately, a thorough investigation is key to getting the best deal and knowing the true price you’ll pay.

What is the best time of year to buy a new car?

The end of the month and the end of the quarter are often good times to negotiate, as dealerships are typically more motivated to meet sales quotas.

How long should I negotiate for a car?

There’s no set timeframe. Be prepared to walk away if you don’t feel the deal is fair. A respectful yet firm approach is key.