What Price to Pay for a New Car?

Factors Influencing New Car Prices

What price to pay for a new car – The price of a new car is a complex interplay of various factors. Understanding these factors empowers buyers to make informed decisions and potentially negotiate better deals. This section will delve into the key elements that contribute to the final price tag.

Determining the right price for a new car can be tricky, involving careful consideration of various factors. Understanding the true market value is crucial, and a helpful resource for this is checking out the guide on true market price new car to avoid overpaying. Armed with this knowledge, you can confidently negotiate a fair price that aligns with your budget and the vehicle’s actual worth.

Vehicle Make and Model Impact on Price

The manufacturer and specific model significantly influence price. Luxury brands like Mercedes-Benz and BMW generally command higher prices than mainstream brands like Honda or Toyota. Even within a single brand, different models are priced differently based on their size, features, and performance capabilities. For example, a BMW 7 Series will be considerably more expensive than a BMW 3 Series.

Engine Size and Type Influence on Cost

Engine size and type directly impact a vehicle’s price. Larger engines, especially those with higher horsepower and torque, usually translate to higher costs. Similarly, more advanced engine technologies, such as hybrid or electric powertrains, often come with a premium price tag. A larger V8 engine will generally be more expensive than a smaller 4-cylinder engine, and an electric vehicle will often cost more than a comparable gasoline-powered vehicle.

Features and Options Influence on Price

Optional features and packages significantly impact the final price. Items like sunroofs, navigation systems, leather interiors, advanced safety features, and premium sound systems all add to the overall cost. Buyers should carefully consider the value they place on these features against their added expense. A sunroof might add a few thousand dollars, while a full technological package could add significantly more.

Fuel Efficiency Ratings and Price

Fuel efficiency ratings play a role in determining price, though the relationship isn’t always straightforward. Vehicles with higher fuel economy ratings (measured in MPG or MPGe) may command a slightly higher initial price due to the advanced technologies required to achieve that efficiency, such as hybrid or electric components. However, the long-term savings on fuel can offset this initial investment.

Safety Ratings and Technology Features Impact on Cost

Higher safety ratings and advanced technology features typically increase the price. Features like automatic emergency braking, lane departure warning, adaptive cruise control, and advanced driver-assistance systems (ADAS) contribute to a vehicle’s safety and often come with a price premium. Vehicles with top safety ratings from organizations like the IIHS and NHTSA tend to be priced higher.

Comparison of Similar Cars from Different Manufacturers

The following table illustrates how prices vary for similar vehicles across different manufacturers with varying features:

| Manufacturer | Model | Engine | Features | Price (USD – Estimated) |

|---|---|---|---|---|

| Toyota | RAV4 | 2.5L I4 Hybrid | Standard Features | $30,000 |

| Honda | CRV | 1.5L I4 Turbo | Standard Features | $28,000 |

| Mazda | CX-5 | 2.5L I4 | Standard Features | $29,000 |

| Subaru | Forester | 2.5L I4 | Standard Features + EyeSight | $32,000 |

Negotiating the Price of a New Car

Negotiating the price of a new car can be daunting, but with the right strategies, you can secure a fair deal. Effective negotiation requires preparation, research, and confidence.

Strategies for Negotiating with Car Dealerships

Successful negotiation involves understanding the dealer’s perspective, researching market value, and presenting a well-reasoned offer. Knowing your walk-away price is crucial – the maximum amount you’re willing to pay. Be polite but firm, and don’t be afraid to walk away if the deal isn’t right.

Techniques for Determining a Fair Price, What price to pay for a new car

Determining a fair price requires thorough research. Utilize online resources like Kelley Blue Book (KBB) and Edmunds to find the fair market value for the specific make, model, year, and features of the vehicle you’re interested in. Consider the vehicle’s condition, mileage, and any available incentives or rebates.

Step-by-Step Guide for Price Negotiations

A structured approach to negotiation is beneficial. Begin by stating your desired price based on your research. Be prepared to justify your offer. Listen carefully to the dealer’s counteroffers and respond thoughtfully. Don’t rush the process, and be willing to compromise, but within your predetermined limits.

Comparison of Different Negotiation Tactics

Several negotiation tactics exist, including “lowballing” (offering a significantly low price), negotiating features instead of price, and focusing on the total out-the-door price. The effectiveness of each tactic depends on the specific situation and the dealer’s willingness to negotiate. Lowballing can be risky, while focusing on the total price avoids haggling over individual items.

Using Online Resources to Research Fair Market Value

Websites like Kelley Blue Book (KBB), Edmunds, and TrueCar provide valuable tools for determining a vehicle’s fair market value. These websites allow you to input specific details about the car you are interested in and receive an estimated price range based on market data. Comparing prices across multiple sources provides a more comprehensive understanding of the vehicle’s worth.

Key Questions to Ask the Salesperson During Negotiations

Asking the right questions is crucial during negotiations. Inquire about the dealer’s invoice price, any available rebates or incentives, financing options, and the total out-the-door price (including taxes, fees, and registration). Don’t hesitate to ask for clarification on any unclear aspects of the deal.

- What is the dealer’s invoice price for this vehicle?

- Are there any rebates or incentives currently available?

- What financing options do you offer?

- What is the total out-the-door price, including all fees and taxes?

- What is the warranty coverage on this vehicle?

Financing a New Car Purchase: What Price To Pay For A New Car

Source: zimlon.com

Financing a new car purchase typically involves securing an auto loan. Understanding the various financing options and terms is crucial to securing the best possible deal.

Different Financing Options Available to Car Buyers

Several financing options exist, including loans from banks, credit unions, and the dealership itself. Each option has its own advantages and disadvantages regarding interest rates, loan terms, and fees. Shop around for the best rates and terms before committing to a loan.

Securing an Auto Loan from a Bank or Credit Union

Banks and credit unions often offer competitive auto loan rates. The process typically involves applying for a loan, providing financial information, and undergoing a credit check. Pre-approval from a bank or credit union can strengthen your negotiating position at the dealership.

Comparison of Loan Terms, Interest Rates, and Repayment Schedules

Loan terms, interest rates, and repayment schedules significantly impact the total cost of the loan. Shorter loan terms result in higher monthly payments but lower overall interest paid. Lower interest rates reduce the total cost of the loan. Compare offers from multiple lenders to find the most favorable terms.

Strategies for Securing the Best Possible Financing Terms

Source: carhampt.com

To secure the best financing terms, maintain a good credit score, shop around for the best rates, and negotiate with lenders. Consider pre-approval from a lender before visiting the dealership to leverage a stronger negotiating position. Also, compare offers from different lenders, including the dealership’s financing options.

Implications of Different Down Payment Amounts on Monthly Payments

A larger down payment reduces the loan amount, resulting in lower monthly payments and potentially lower overall interest paid. However, it also requires a larger upfront investment. The optimal down payment amount depends on your financial situation and comfort level.

Leasing Versus Buying: Advantages and Disadvantages

Leasing and buying offer distinct advantages and disadvantages. Leasing typically involves lower monthly payments and the opportunity to drive a newer vehicle more frequently. However, you don’t own the vehicle at the end of the lease term, and mileage limits can result in penalties. Buying offers ownership and greater flexibility but usually involves higher monthly payments and depreciation.

- Leasing: Lower monthly payments, drive a newer car frequently, no vehicle maintenance responsibility (usually).

- Buying: Ownership, greater flexibility, potential for long-term cost savings.

Hidden Costs Associated with New Car Purchases

Beyond the sticker price, several hidden costs can significantly increase the total cost of a new car. Awareness of these costs is essential for budgeting and negotiation.

Various Fees Associated with New Car Purchases

Numerous fees can add to the final price, including dealer fees, destination charges, taxes, registration fees, and document preparation fees. These fees can vary significantly between dealerships and locations. It’s crucial to understand each fee’s purpose and negotiate its inclusion in the final price.

Impact of Extended Warranties and Maintenance Packages

Extended warranties and maintenance packages offer additional protection and convenience but often come at a considerable cost. Carefully evaluate the value of these options against their price. Consider your vehicle’s reliability and your personal risk tolerance before purchasing.

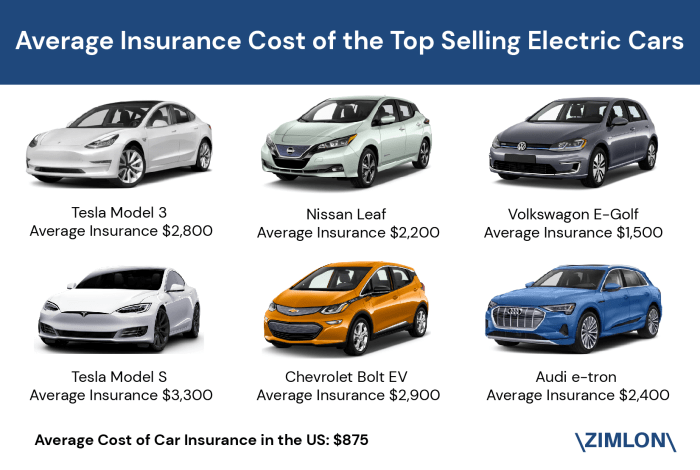

Breakdown of Insurance Costs

Insurance costs vary based on several factors, including the vehicle’s type, the driver’s profile (age, driving history, location), and coverage levels. Obtain quotes from multiple insurers to compare costs and coverage options before finalizing your purchase.

Tips on Avoiding Unnecessary Add-on Costs

Avoid unnecessary add-ons by carefully reviewing all documents before signing. Don’t feel pressured to purchase additional products or services you don’t need or want. Negotiate the inclusion of any desired add-ons as part of the overall price.

Potential Hidden Costs and Strategies to Minimize Them

Be aware of potential hidden costs to avoid unpleasant surprises. Negotiate the price upfront, carefully review all documents, and understand all fees involved. Shop around for the best insurance rates and consider your need for extended warranties and maintenance packages.

- Dealer fees: Negotiate these fees down or eliminate them if possible.

- Extended warranties: Carefully consider the value and cost before purchasing.

- Add-on products: Avoid unnecessary add-ons like paint protection or fabric sealant.

- Documentation fees: Inquire about the nature of these fees and negotiate if possible.

Examples of Different Fees and Their Typical Amounts

| Fee | Typical Amount (USD – Estimated) |

|---|---|

| Dealer Fee | $500 – $1500 |

| Destination Charge | $1000 – $1500 |

| Taxes | Varies by location |

| Registration Fees | Varies by location |

| Document Preparation Fee | $100 – $300 |

The Total Cost of Ownership

The total cost of ownership (TCO) encompasses all expenses associated with owning a vehicle, extending beyond the initial purchase price. Understanding TCO helps make informed purchasing decisions.

Factors Contributing to TCO Beyond the Initial Purchase Price

Several factors contribute to TCO, including fuel costs, insurance premiums, maintenance and repairs, depreciation, and financing charges. These expenses accumulate over the vehicle’s lifespan, significantly impacting the overall cost.

Comparison of TCO of Different Vehicle Types

Different vehicle types have varying TCOs. Fuel-efficient vehicles generally have lower fuel costs, while larger vehicles may require more expensive maintenance and repairs. SUVs and trucks often have higher insurance premiums than sedans. Consider your needs and driving habits when comparing TCOs across different vehicle types.

Methods for Estimating the Long-Term Cost of Owning a Specific Vehicle

Source: roadloans.com

Estimating long-term costs involves considering all expenses over the vehicle’s anticipated lifespan. Use online tools and resources to estimate fuel consumption, maintenance costs, and depreciation. Factor in insurance premiums and financing charges to obtain a comprehensive TCO estimate.

How Fuel Costs, Maintenance, and Repairs Affect TCO

Fuel costs, maintenance, and repairs are significant contributors to TCO. Fuel-efficient vehicles reduce fuel expenses, while regular maintenance can prevent costly repairs. Consider the vehicle’s reliability and the availability of affordable parts and service when assessing these factors.

TCO Comparison: Fuel-Efficient Hybrid vs. Gas-Powered Vehicle

The following table compares the estimated TCO of a fuel-efficient hybrid vehicle and a gas-powered vehicle of similar size and features over five years:

| Cost Category | Hybrid Vehicle (Estimated) | Gas-Powered Vehicle (Estimated) |

|---|---|---|

| Purchase Price | $35,000 | $30,000 |

| Fuel Costs (5 years) | $6,000 | $10,000 |

| Maintenance & Repairs (5 years) | $3,000 | $4,000 |

| Insurance (5 years) | $6,000 | $6,000 |

| Depreciation (5 years) | $15,000 | $15,000 |

| Total Cost of Ownership (5 years) | $65,000 | $65,000 |

Top FAQs

How much should I put down on a new car?

The ideal down payment varies based on your financial situation and loan terms. A larger down payment reduces the loan amount, lowering interest paid over time, but also requires a larger upfront investment.

What is the best time of year to buy a new car?

The end of the month and the end of the quarter are typically favorable times to negotiate, as dealerships often strive to meet sales quotas. However, deals can be found year-round with diligent research and negotiation.

How long should car negotiations take?

Negotiations can vary greatly. Aim for a reasonable timeframe, but be prepared to walk away if a fair deal isn’t offered. Don’t rush the process.

Can I negotiate the interest rate on my auto loan?

Yes, it’s often possible to negotiate interest rates, especially if you have good credit. Shop around for loans from multiple lenders to compare rates and terms.